Analysis

Gas Export Earnings: The EGTL Revenue Blind Spot

BY EGUONO ODJEGBA

There is an intentional conspiracy of silence about the revenue statistics and administration flowing from the operation of the Escravos Gas-to-Liquids (EGTL) Project.

Everyone and all relevant bodies including regulatory, monitoring and oversight institutions not only appear hamstrung on the issue of EGTL financials but the silence suggests a mystery of both collusion and inertia.

Regarded as Delta’s billion-dollar black box, if there is a statutory body mandated to track the EGTL’s Gas-to-Liquids revenue, such information is either been hoarded or exist within designated official quarters who are sworn to secrecy.

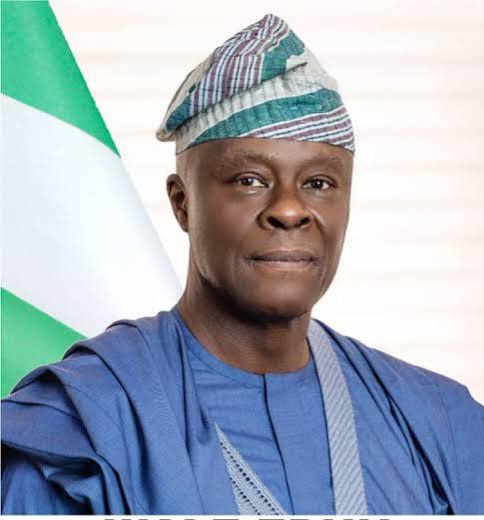

Delat State Gov Sheriff Oborevwori

But even if such a possibility does exist, the powers-that-be, and in this instance, Aso Rock, also believed to be in the know of the NNPCL controversial secret accounts; is in the know of the figures and facts and abreast of developments in Escravos, Delta State.

The EGTL revenue disclosure is to say the least, long overdue. We cannot continue the regime of an opaque financial system in a rich gas sub sector enabled by an utterly poor data system via government apparent backing; that is criminal. The EGTL economic footprint must be kept open and Delta state and its people must be aware of how monies accruing from the project is shared and utilized in a transparent manner.

The Escravos Gas-to-Liquids (EGTL) Project has generated significant revenue since its launch, but detailed public disclosures on its financial flows and deployment remain limited and opaque.

Project Overview

Location: Escravos, Delta State, Nigeria

Partners: Chevron Nigeria Limited (CNL) – 75%, Nigerian National Petroleum Company (NNPC) – 25%

Capacity: 33,000 barrels per day (bpd) of synthetic fuel

Cost: Estimated at $10 billion

Operational: Since 2014

Revenue Generation

The EGTL plant converts natural gas into synthetic diesel and naphtha for export.

Revenue is generated primarily through international sales of these refined products, priced in USD. Given its 33,000 bpd output, annual revenue could range between $800 million to $1.2 billion, depending on global oil prices.

Financial Disclosure & Deployment

Transparency Issues: There is limited public access to detailed revenue breakdowns or how funds are deployed. Neither Chevron nor NNPCL regularly publish EGTL-specific financial statements.

Minister of Finance, Wale Edun

Delta State Government Reports: While Delta State’s audited financial statements (e.g., 2023 report) include general oil revenue allocations, the report failed to aggregate EGTL contributions. While a study covering 2012–2022 shows a strong correlation between oil revenue and state expenditure, it must be stated that such lump up is unhealthy and too cold for comfort.

Deployment of Revenue

Federal Allocation: Investigations have shown that EGTL revenues are likely pooled into Nigeria’s Federation Account, from which Delta State receives monthly allocations.

State Use: Funds are deployed for infrastructure, education, and health, but tracking EGTL-specific impact is difficult due to aggregation with other oil revenues.

Loan Repayments: While findings suggest that some revenue may have been used to service loans taken for EGTL’s construction, especially given its high capital cost, these obligations will in no wise subtract from a system financial disclosure.

The secrecy surrounding EGTL’s revenue administration stems from a combination of institutional opacity, weak regulatory oversight, and the nature of joint venture operations between NNPCL and Chevron.

Sadly, JVs in Nigeria’s oil sector often lack independent financial audits accessible to the public. Thus, revenue flows are typically managed internally, with limited external scrutiny. This is very concerning and should be reviewed.

In EGTL, there has been reported cost overruns and budget inflation. The project’s cost ballooned from $2.9 billion to $10.7 billion, triggering investigations by Nigeria’s House of Representatives sometime in the past.

Lawmakers questioned the rationale behind this massive upward review, suggesting possible mismanagement or concealed expenditures. But given the hot-and-cold character of our lawmakers due to concerns of compromise, the required traction to push for openness hit the brick wall.

Weak Institutional Oversight

Nigeria’s extractive sector has long struggled with transparency and accountability, despite frameworks like NEITI (Nigeria Extractive Industries Transparency Initiative).

EGTL’s financial disclosures are not separated in public budgets or reports, making it hard to track revenue generation or deployment. In the long run, calls for transparency often clash with vested interests within government and corporate circles. This is made worse by bureaucratic bottlenecks and lack of enforcement mechanisms which hinder public access to detailed financial data.

Hon. Ekperikpe Ekpo, Minister of State for Gas

While NEITI has raised concerns about transparency in Nigeria’s extractive sector, there is however no public record of a targeted investigation into the EGTL Project revenue question. Its broader audits highlight systemic issues, yet outcomes have remained limited due to weak enforcement and political inertia.

Transparency and accountability must remain a constitutional article of the masses right, and must be all encompassing; and should in no wise shield any segment of the national economy, neither the extractive solid mining sector nor the JVCs.

The Presidency and all its organs including the National Assembly should be getting ready to provide financial statement on the nation’s rich mining activities in the North Western region of this country.

It is concerning how this government and failed previous politicians are busy strategizing for 2027 election, without any serious and equally compelling efforts to resolve the Zamfara Mining Belt dominated by non state actors – to integrate its revenues into the federation account.