News

Customs Duty Fluctuation: ANLCA Will Shut Down Ports If…

BY EGUONO ODJEGBA

The Association of Nigeria Licensed Customs Agents (ANLCA) has called on the Federal Ministry of Finance, Central Bank of Nigeria and other relevant MDAs to urgently reign in the ongoing erratic customs duty benchmark on import calculation, failure which members will withdrawal their services leading to the shutdown of the ports.

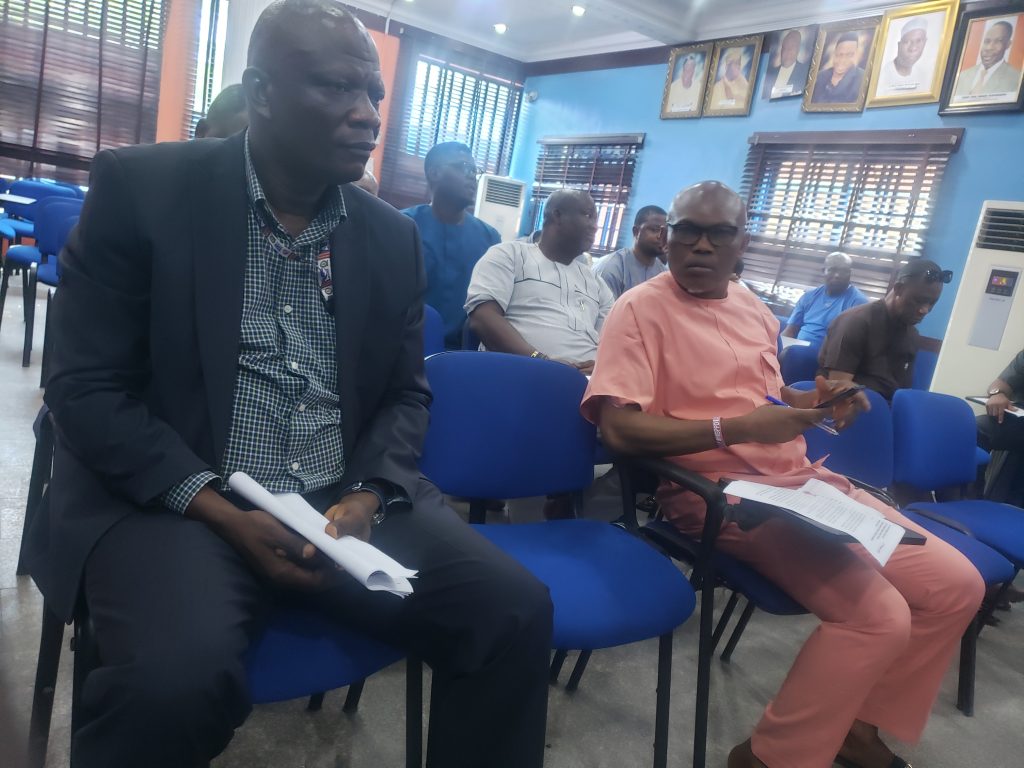

NP Nwokeoji and members of the NEC during the press briefing

Addressing the media in its National Secretariat at Amuwo Odofin Lagos, the National Executive Council (NEC), consisting of the National Officers and members of the Board of Trustees, Thursday, February 22, 2024.

The freight forwarders and customs brokers who said the persistent fluctuation of the exchange rate for Customs duty has led to unhealthy distortions in the trade process resulting negative colossal economic losses and threatened to shut down the nation’s seaports if the problem is not addressed timely.

The association warned it would explore necessary strategic partnership with allied groups including the Nigerian Labour Congress (NLC), Maritime Workers Union of Nigeria (MWUN) among players in the economic sector like NACCIMA to ensure total shutdown of the port system and the national economy.

Addressing the press, ANLCA President, Mr. Emenike Nwokeoji said that although the NEC has learnt that there are ongoing interactions and engagements between the CBN and other relevant authorities, he expressed utter frustration at the damage the economy is being subjected due to the ongoing duty fluctuation that has thrown the import value chain into avoidable crisis flowing from the seeming inability of the nation’s economic managers to speak to the issues by pulling the right levers.

Nwokeoji expressed disappointment that while the country which depends largely on import is gradually slipping out of control, the presidential economic team and the nation’s economic managers are merely reciting decadent academic foreign economic principles without at the same time taking cognizance of the interplay of necessary interventions often embarked upon by the so-called advanced western economies they have resolved to subscribe to and to copy.

He said, “The issue of foreign exchange rates in relation to the Naira has become somewhat intractable that we as the mouthpiece of the Customs brokers/freight forwarders in Nigeria can no longer afford to be silent.

“It is a well known fact that Nigeria’s trade has a predominant foreign exchange content and Nigeria being an import-dependent country, the effect of any exchange rate distortions can be devastating. Our major concern is about the exchange rates being used in computing the import duty and other charges payable on imports and of attendant effects in promoting trade.”

According to the ANLCA President, those at the helms of affairs appear to have resigned themselves to the Breton Woods institutional observatory where they merely watch the devalued naira submit absolutely to the law of supply and demand; unconcerned about its devastating effects of the economy.

“We now have a situation where the exchange rates which were in the neighbourhood of 483 Naira to a US Dollar eight (8) months ago have continued shooting up to now close to 2000 Naira to a US Dollar, but the appalling thing is the continuous change of the official trade transactional rates sometimes up to twice or thrice in a day (floating exchange rate).

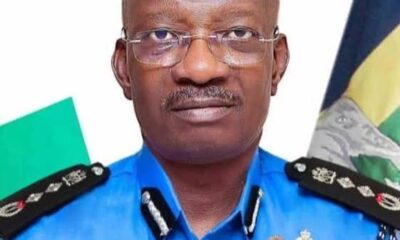

BOT Chairman, Mustapha Taiwo speaking during the engagement

“Apart from the elementary economics that teaches us that no country can afford to allow her currency to be subjected to the law of supply and demand without hurting her economy, the more pressing issue is that the constant and upward changes in the exchange rate for Customs trade purposes are putting everything in a state of confusion.

Sir Elochukwu also making some points during the briefing

“For one, it does not allow for planning by business entities in their import business endeavours. A company does not have the opportunity to estimate.

the costs of its imports to ascertain the viability of a certain transaction. It is more frustrating for companies with bank financing.”

He explained that the defects and distortions on trade have thrown members and their clients in the port economy into utter misery and disarray.

Vice President, Oduntan during the engagement

“On our part as Customs Agents/Brokers/Freight Forwarders, we now find it impossible to make credible quotes for jobs as the constant upward reviews of exchange rates render such quotes impracticable. Even the already contracted jobs are experiencing huge difficulties.

“Our members have cried out in agony and as a responsive leadership of the Association, we made moves to the Comptroller General of Customs and his management team, the explanation we got was that the rates are automatically generated by the Central Bank of Nigeria (CBN) hence they (the Customs) could not do anything about it.”

He called on the policy makers to look inward and come up with urgent solution as no country can afford to subject its economic entirely to the dynamics of international flow of demand and supply under a pressured currency control.

“We are therefore calling on the Federal Government of Nigeria to direct the Central Bank of Nigeria (CBN) and other authorities involved in the exchange rate issuance to urgently stem the tide of this tension which may sound a death knell on import trade sooner than later.

“In as much as we appreciate that there are many factors that may be propelling the present exchange rate fiasco and equally believe that the government is taking measures to tackle them, we make bold to suggest that the exchange rate for Customs Clearance purposes should be stabilized by fixing it over a period of time (minimum of six months).

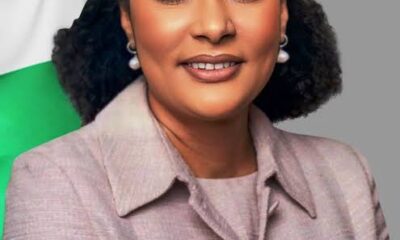

NP Nwokeoji

“The time frame being suggested is advised by the usual time it takes to start. and conclude an import transaction putting into consideration all the myriads of impediments on the path of international trade nowadays.”

Also speaking, the Chairman, Board of Trustees (BoT), ANLCA, Alhaji Taiwo Mustapha, and member board of trustees and former national president, Chief Sir Ernest Elochukwu, who respectively aligned with the position of Nwokeoji , warned that should the situation persist, Nigeria may run into a state of anomie and descent when the poor masses loses their purchasing power.