Maritime

Stakeholders Caution On Long Term Implications of Nigeria/China Currency Swap

…As CBN Highlight Gains

BY EGUONO ODJEGBA

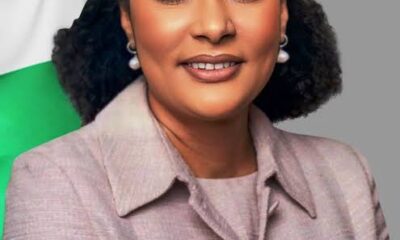

L-R : Representative of Nigeria -China Strategic Paternership, Mr Martins Olajide, CBN Governor Representative, Mr Anthony Ogufere, SA to CBN Governor,Chairman of the occasion, Aare Hakeem Olanrewaju, chairman, Customs Consultative Forum, Chief (Mrs) Ezenwa,CEO, Le Look, Mr Godfrey Bivbere, MARAN president, Barr. Emeka Akabuogu, Dr Farinto, Fmr Acting President,ANLCA , Dr Mubarak Mahmoud,Customs Relations,Importers Association of Nigeria( IMAN) Mr Lucky Amiwero, National President, NCMDLCA.

While the Central Bank of Nigeria (CBN) has said that the Nigeria-China currency swap deal remains a transformative policy instrument that will significantly reduce shipping costs, enhance trade efficiency and ease the pressure on foreign exchange mobilization; players have urged the federal government to be more assertive and purposeful in determining the end results.

Speaking at a stakeholders’ breakfast meeting organized by the Maritime Reporters’ Association of Nigeria (MARAN) in Lagos on Tuesday, the CBN Governor, Mr. Olayemi Cardoso, stated that the agreement—originally signed in 2018 and recently renewed in December 2024—enables Nigerian and Chinese businesses to conduct trade directly in naira and yuan, strategically aimed at providing an alternative foreign exchange to the U.S. dollar.

Speaking on the theme of the workshop, “Navigating the Nigeria-Peoples Republic of China Currency Swap: Opportunities and Challenges for Import, Export and Maritime Business” Cardoso said:

“The swap agreement simplifies the settlement of trade transactions in local currencies and reduces the pressure on Nigeria’s dollar reserves. This, in turn, lowers the cost of doing business and enhances the competitiveness of Nigerian trade.”

The CBN Governor who was represented by Mr Anthony Ogufere, Special Adviser to CBN Governor on Finance and Strategy noted that China become Nigeria’s largest trading partner by the end of 2024, accounting for about 35% of total imports and reaching a trade volume of $11.58 billion.

He added that the maritime sector, which handles the majority of Nigeria’s import and export activities, stands to benefit immensely through faster port clearance, improved trade finance instruments, and direct shipping links through the Lekki Deep Sea Port—a Chinese-backed infrastructure project under the Belt and Road Initiative.

The CBN Governor who however acknowledged that several challenges still hinders the full potential of the currency swap, noted that chief amongst the present challenges is Nigeria’s significant trade imbalance with China and the limited adoption of yuan-denominated transactions by Nigerian businesses.

The CBN emphasize that while its statutory task is confined to providing a friendly trading atmosphere by ensuring that price stability is achieved, it is up to policy makers and the productive sector to define operational issues in line with a friendlier, more competitive foreign exchange realities.

Ogufere said, “CBN is focused on price stability, in an institutional responsibility, because it one that offers manufacturers the template to plan, they can only plan successfully when there is price stability. The onus is to bring policy makers and operators together to crystallize the fundamental issues.”

He called for greater sensitization, policy coordination, and efforts to expand non-oil exports to China.

Firing the first salvo, the Importers Association of Nigeria (IMAN) which expressed misgivings about the inclusiveness of stakeholders during the Nigeria-China Currency Swap deal said urgent steps must be taken underscore industrial diversification and infrastructural development; even the group warned that Nigeria risks becoming a dumping ground for Chinese products, if the presidency fails to leverage the currency swap deal to boost local manufacturing and to minimize our current status as import dependent economy.

Dr. Ibrahim Mahmoud Mubarak, Director of Customs and Extant, Trade Facilitation, IMAN Special Taskforce, emphasized that without significant investment in local industry, the currency swap arrangement may further tilt the trade balance in favour of China.

Noting that the deal offers opportunities for smoother trade and reduced pressure on Nigeria’s dollar reserves, Dr. Mubarak however expressed concern that the deal could however lead to long-term economic consequences if not properly managed; warning of increased trade imbalances through decline in local production.

“Economically, if we subject the relationship between Nigeria and China to analytical review, it fits within the dependency theory, where Nigeria continues to play the junior partner role. This deal, without strategic economic reengineering, will only deepen that imbalance,” he stated.

Also speaking, former helmsman of the National Inland Waterways Authority (NIWA), Chief (Mrs.) Chinwe Ezenwa, lamented that but for MARAN which has initiated a public dialogue on the currency swap deal, the government failed to carry stakeholders along.

Chief Ezenwa therefore raised concerns about the nature of Nigeria’s trade relationship with China, especially on the backdrop of concerns amongst underdeveloped and developing countries that Chinese business and trade deals always have hidden, unpleasant undertones.

“The swap deal should be a tool for economic empowerment, not a trap. Let it support innovation, industrial development, and fair exchange of value between both countries”, she said.

The Nigeria-China Strategic Partnership (NCSP), represented at the event by Mr. Martins Olajide, offered a more cautious outlook. He noted that while the swap deal provides short-term relief and smoother trade operations, it is not a sustainable solution especially in view of he naira’s persistent depreciation.

Olajide warned that Nigeria’s economic vulnerability and dependence on imports, especially from China, tend to undermines the true impact of the agreement and advocated the need to engage in structural reforms, particularly in industrialization, value addition, and local production.

“Without these changes, the swap deal may only reinforce economic dependence on China without solving the underlying issues. China knows what they want, we should also know what we want.

‘It is important that we reverse the trend where we are always left holding unto the end of the negotiation stick. Genuine economic partnership should be one that promotes equal opportunity, Nigerian is an agricultural nation blessed with lots of mineral resources. We should make Nigeria a manufacturing hub, China should be discouraged from coming to dump their products here, they should be encouraged to bring equipments to manufacture here, to engage in mechanized mining and agriculture in Nigeria from where they can export.”

Also speaking, erudite maritime lawyer, Dr. Emeka Akabogu observed that China and other foreigners operating illegally in Nigeria do so because of the absence of control, citing the porous mining subsector as example.

In his opening remarks, the Chairman of the event and Chairman of the Customs Consultative Council (CCC), Aare Akeem Olarenwaju, decried the volatility of the naira-dollar exchange rate and called for greater public awareness of alternative currency options like the Chinese yuan.

“You can’t determine the price of goods within a few hours due to constant exchange rate changes. Today it’s ₦1,600 to a dollar, and in the next few hours, it could be ₦1,700 or ₦1,500. It’s the common people who suffer the most,” Olarenwaju lamented.

He commended MARAN for kick starting the discussion and urged media professionals to help educate the public on alternatives that could reduce the nation’s dependence on the U.S. dollar; and to ensure that the China-Nigeria swap deal is not skewed into unduly benefiting one side.

Earlier in his welcome address, MARAN President, Mr. Godfrey Bivbere, reaffirmed the association’s commitment to promoting dialogue on key economic issues.

While acknowledging the swap deal’s promise in reducing transaction costs and enhancing trade efficiency, Bivbere stressed the need for a balanced discourse.

“We are not only here to applaud progress but also to interrogate policy. We must understand both the positive impact and the underlying risks associated with China’s expanding economic footprint in Nigeria,” he said.

The MARAN leader urged stakeholders across the maritime, trade, and financial sectors to approach the Nigeria-China currency swap with critical insight, noting that sustainable benefits would only come through policies that protect national economic interests while encouraging growth and competitiveness.