Uncategorized

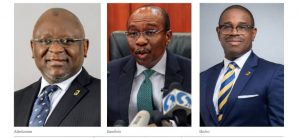

Zenith Bank boss fate hangs in the balance as CBN fires 1-day First Bank MD

This is not the best of times for leading Nigerian commercial banks as the Central Bank of Nigeria (CBN) yesterday relieved Gbenga Shobo, one day managing director of First Bank of Nigeria, of his appointment, ostensibly to stem recent unpleasant crisis that has engulfed the institution over the appointment said to have been politically motivated.

His appointment announced Wednesday, April 28, 2021, immediately ran into trouble waters reportedly for lack of proper consultations and proper board consent, even though being the bank’s deputy managing director; Shobo is next in line to the outgoing managing director, Adesola Adeduntan, whose tenure is expected to terminate properly by December this year.

While the CBN has been able to take decisive and swift action to mitigate the crisis arising the unfortunate leadership schism that is now threatening the integrity of the bank’s image, the apex regulatory body has failed to respond in similar measure to crisis believed to have engulfed Nigeria’s most innovative, most reliable ICT driven financial institution, Zenith Bank.

The Zenith Bank crisis followed the recent controversial appointment of Mr. Ebenezer Nduka Onyeagwu , on the grounds of his blood relationship with the bank’s founder and current chairman, Mr. Jim Ovia.

So far, the actions of the CBN is believed to have effectively thrown spanners on the convoluted succession plot targeted at the forceful removal of Adeduntan, who is billed to retire in December 2021, in accordance with the laid down rules, having headed the position since 2016; without any subsisting query.

In a letter addressed to the chairman of First Bank, Ibukun Awosika, CBN faulted Shobo’s appointment on the ground that the appointment was covertly political and an attempt to stampede the premature departure of Adeduntan, the current managing director, who has until December this year to go.

The CBN letter reads:

“The CBN notes with concern that the action was taken without due consultation with the regulatory authorities, especially given the systemic importance of First Bank Ltd. Given that the tenure of Dr. Adeduntan is yet to expire and the CBN was not made aware of any report from the Board indicting the Managing Director of any wrongdoing or misconduct, there appears to be no apparent justification for the precipitate removal.

“We are particularly concerned because the action is coming at a time the CBN has provided various regulatory forbearances and liquidity support to reposition the bank which has enhanced its asset quality, capital adequacy, and liquidity ratios amongst other prudential indicators. It is also curious to observe that the sudden removal of the MD/CEO was done about eight months to the expiry of his second tenure which is due on December 31, 2021.

“The removal of a sitting MD/CEO of a systemically important bank that has been under regulatory forbearance for 5 to 6 years without prior consultation and justifiable basis has dire implications for the bank and also portends significant risks to the stability of the financial system.”

In unhidden righteous indignation, the CBN commanded the FBN board to explain why sanctions should not be taking against it for the unwarranted attempt to cause internal crisis in the bank, even as the financial regulator ordered the bank to maintain absolute quiet on the matter, warning the board against further public statement.

“In light of the foregoing, you are required to explain why disciplinary action should not be taken against the Board for hastily removing the MD/CEO and failing to give prior notice to the CBN before announcing the management change in the media.

“In the meantime, you are directed to desist forthwith from making any further public/media comments on the matter. Your comprehensive response on the foregoing should reach the Director, Banking Supervision Department on or before 5pm on April 29, 2021.”

The CBN letter signed by Mr. Haruna B. Mustafa, fingered mega investment guru and FBN ex-chairman, Oba Otudeko, as the brain behind the current crisis and plot to dislodge the incumbent managing director.

It would appear that FBN has courted more trouble setting off this failed plot as the CBN took time to look into the bank’s books to unearth other issues of aggravated regulatory disobedience as the CBN slammed the first generation but upwards mobile banking giant for failing to comply with regulatory directives to divest its interest in Honey-Well Flour Mills despite several reminders.

“We further noted that after 4 years the bank is yet to perfect its lien on the shares of Mr. Oba Otudeko in FBN Holdco which collateralized the restructured credit facilities for HoneyWell Flour Mills contrary to the conditions precedent for the restructuring of the company’s credit facility.

“Given the bank’s failure to perfect the pledge and satisfy conditions for regulatory approval, the restructuring has thus been invalidated and the credit facilities now payable immediately.

“Consequently, the company is required to fully repay its obligations to the bank within 48 hours failing which the CBN will take appropriate regulatory measures against the insider borrower and the bank.

“Furthermore, the Bank notes the untenable delay in resolving the long outstanding divestment from Bharti Airtel Nigeria Ltd in line with extant regulations of the CBN”, as the bankers bank directed:

“Accordingly, you are required to divest the equity investments in all non-permissible entities such as HoneyWell Flour Mills and Bharti Airtel Nigeria Ltd within 90 days. Please forward evidence of compliance in accordance with the timelines above to the Director of Banking Supervision.”

Reacting on the CBN intervention on the FBN crisis, a retired commercial bank auditor and financial expert, Pius Otshuko Obi applauded CBN for engaging in judicious and professional intervention, unlike in the past.

He said, “This intervention is more civil than the takeover of nine banks under Lamido Sanusi regime. Regulatory interventions should be apolitical, this is a good example.”

In a similar development, intense pressure is said to being piled on the CBN Governor, Mr. Godwin Emefiele to sack Onyeagwu, Zenith Bank newly appointed managing director, which appointment is believed to have ran foul of the corporate governance rules enshrined in the Code of Corporate Governance for Banks and Discount Houses in Nigeria of May 2014.

Impeccable authoritative sources also hints of pressure allegedly been mounted by the presidency to reverse the appointment. Unlike FBN, the Zenith Bank case appears to be burdened with delicate loops and primordial knots which makes untangling appears difficult; on the face on the personal involvement of Emefiele in the whole saga.

Attempts by our reporter to get an update on the development from the bank’s corporate affairs manager, Mr. Tunji Shittu on telephone proved abortive as telephone line rang switched off two days running. He did not also respond to text message sent to him on the issue.

It is not clear how the ongoing rumblings will pan out, but those whose business it is to know posit that this is a litmus test for Emefiele, the CBN boss. He was not only a former managing director of Zenith Bank, his appointment as the apex banking umpire was believed to have been largely influenced by the controversial founder of the leading commercial bank, with a strong brand name as well as strong offshore tentacles.