Uncategorized

Banking on Impunity: Zenith Slammed for Criminal Freeze Tactic Backed by Police

BY GBOGBOWA GBOWA

For decades, Nigeria’s elite financial institutions have flaunted their political connections like armour, shielding them from accountability while trampling the rights of ordinary citizens.

But on July 16, 2025, the High Court in Abuja delivered a thunderous reality check, in which Zenith Bank Plc, one of Nigeria’s banking giants, was ordered to cough up ₦85 million in damages and costs for unlawfully freezing a customer’s account using a bogus court order.

Delivering the landmark judgment, an Abuja High Court Judge, Justice S. U Bature held that the bank acted on an invalid order made by a Magistrate Court that lacked the requisite jurisdiction. According to Justice Bature the decision of the bank and the Nigeria Police Force (NPF), the 2nd defendant in the suit to freeze the customer’s account, based on a supposed order by the Magistrate Court, without notifying the said customer, was illogical and a betrayal of the banker-customers’ relationship. The judge lamented that it was unfortunate that a major financial institution like Zenith Bank, with a Legal Department, supposedly manned by lawyers, would claim to have acted based on an invalid order, including issuing orders for the freezing of a bank account.

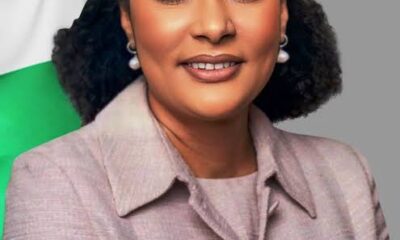

The judgment delivered on July 16 which certified true copy (CTC) was made available to newsmen on Thursday in Abuja by Paulyn O. Abhulimen, SAN, trading under the name of Abhulimen & Co, had, in the suit marked FCT/HC/CV/2194/2024, sued the Zenith Bank and NPF as 1st and 2nd defendants.

Abhulimen who sued through the law firm of Kehinde & Partners LP, claimed that in 2024, after being unable to access the account of her firm, Abhulimen & Co, and make transactions with it, discovered that the bank had placed a post-no-debt (PND) on it.

According to the lawyer, Abhulimen claimed to have subsequently contacted her account, Obi Okafor, who reportedly told her about the development. Okafor reportedly explained that the bank on March 13, 2024 claimed to have frozen the account based on an order obtained by the NPF from a Chief Magistrates Court in Mararaba Gurku, Nasarawa State.

Justice Bature inn her judgment also ordered the bank to immediately unfreeze the account domicile in its branch at 63, Usuma Street, Maitama, opposite Transcorp Hilton Hotel, Abuja, in addition to directing the bank to publish a public apology to the customer, Abhulimen & Co, in two national newspapers and on its website.

This is even as the judge said the bank’s actions backed by the Nigeria Police Force (NPF) were not just illegal but were overly brazen and unacceptable.

The High Court Judge who didn’t mince words condemned Zenith Bank for relying on an invalid order from a Magistrate Court in Nasarawa State—a court with zero jurisdiction over banking matters. The judge wondered why the account in question opened in Abuja with the police based in Abuja, resorted to shop for a court in Nasarawa, describing the actions as “illogical” and a betrayal of the sacred banker-customer relationship.

Consequently, the court ruled that Zenith Bank should pay ₦60 million in general damages for the psychological trauma, financial distress, and emotional stress inflicted on the customer, Abhulimen & Co; while an additional ₦25 million was awarded as cost of action.

This case exposes a troubling pattern where powerful institutions exploiting weak oversight by regulatory bodies and cozy relationships with law enforcement to sidestep the law. It’s a wake-up call for Nigeria’s judiciary, regulators, and citizens alike.

Perhaps, the era of unchecked impunity may finally be cracking. Here’s a compelling background that exposes the systemic rot behind cases like Zenith Bank’s—where regulatory loopholes and institutional indifference allow powerful entities to operate above the law.

The Zenith Bank scandal isn’t an isolated misstep, it’s a symptom of a deeper, more dangerous disease plaguing Nigeria’s financial system. For decades, the banking sector has operated in a twilight zone of weak oversight, political patronage, and regulatory blind spots.

While Nigeria’s Constitution clearly assigns banking-related disputes to the Federal High Court, yet banks routinely exploit lower courts with no jurisdiction to obtain favorable orders. This legal ambiguity allows institutions to freeze accounts, seize assets, or obstruct transactions often without notifying customers; to the extent of conniving with rogue characters and though dubious legal instruments purporting the death of an account holder and consequently transferring the account holder’s funds to impostors.

There can be no comparing Nigeria’s weak enforcement of corporate governance as ours is perhaps the worst possible scenario, world over. And several factors seem to be responsible, which must be critically looked into. This factor often stems from some banks suffering from unstable board tenures, ownership conflicts, and internal power struggles.

Regulatory bodies like the Central Bank of Nigeria (CBN) and the Nigerian Deposit Insurance Corporation (NDIC) often intervene only after crises erupt—such as the recent revocation of Heritage Bank’s license.

Nigerian banks hold trillions in bad loans, especially in oil and gas sectors. This makes them risk-averse and more focused on asset recovery than customer service. The Asset Management Corporation of Nigeria (AMCON) was created to clean up these toxic assets, but its one-size-fits-all approach has failed to recover most of them.

Above all, regulatory capture and political shielding is the major culprit. Some banks are considered “too big to fail” and enjoy systemic importance. It is argued and rightly so that their collapse could destabilize the economy and so regulators tread lightly.

Meanwhile, political connections often insulate these institutions from meaningful accountability, creating a culture of selective enforcement.

Banks depend heavily on government deposits and revenue collection. When oil prices crash or fiscal discipline falters, liquidity dries up. This dependence makes banks vulnerable to political pressure and undermines their independence.

One can logically say that this Zenith Bank case is a crack in the dam—a glimpse into a system where legal shortcuts, regulatory inertia, and institutional complicity allow financial giants to trample rights with impunity.

Until Nigeria strengthens its supervisory frameworks and closes these loopholes, the bubble of banking invincibility will keep floating—until it bursts again.