Customs Report

Apapa Customs Command Raises the Bar, Collects N86b

BY EGUONO ODJEGBA

The Apapa Area Command of the Nigerian Customs Service has collected a total of ₦86,022,748,549.77 as revenue for the month of October 2021 despite initial glitches that slowed its operations.

According to the Customs Area Controller, Comptroller Malanta Yusuf, the tempo of increase in revenue collection is being sustained through increased volume of trade and strategies emplaced by his office, which has significantly raised stakeholders’ compliance level and also deepened inter agency collaborations.

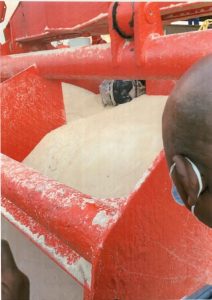

Some of the high profile drugs seizures made within the period under review

This is even as the Apapa Customs boss has lauded the sustained intelligence sharing between the command and sister agencies like the National Drug Law Enforcement Agency (NDLEA), Department of State Service (DSS), Nigeria Police, Nigerian Navy, Nigerian Army and others.

Yusuf’s commendation is coming on the backdrop of the recent joint seizures of 32.9kg of cocaine uncovered in a vessel, MV Cha Yanee Naree, in Apapa Port in October and 74.119kg of captagon pills hidden in various components of machine parts which was seized in September, this year.

A statement by the Command Public Relations Officer, Abubakar Usman, indicated that while import duty fetched ₦38,436,536,897.00; Excise duty stood at ₦199,038,533.00; Common External Tariff (CET) Levy amounted to ₦5,625,077,502.00; with Fees standing ₦401,830,622.00, with a sub total of N44,662,483,554.00.

Also, non federation account revenue collected by the command includes Port Levy ₦2,690,572,938.00; NAC at ₦165,872,139.00; 1% CISS at ₦4,612,963,465.00; 0.5% ETLS at ₦2,688,286,656.00; Sugar Levy at ₦598,518,814.00; Wheat Flour Levy at ₦488,959.00; Iron Levy at ₦47,220,994.00; Wheat Grain Levy at ₦7,892,567,890.00; and NESS Levy at ₦102,989,524.77: which totaled ₦18,799,481,379.77.

In addition, the command collected Value Aded Tax (VAT) amounting to ₦22,560,783,616.00; giving a cumulative grand total of ₦86,022,748,549.77.

Concealed contraband items been extracted from engine parts of imported machinery

While commending port users and stakeholders for their increasing level of compliance, Yusuf urged them to do more by shunning “unlawful activities such as concealments with intent to smuggle; false declaration and under valuation to evade accurate duty payments.”

He said “Any importation that runs contrary to the provisions of sections 46 and 47 of Customs and Excise Management Act CAP C45 LFN 2004 and Customs and Excise Notices No.1491 will not be allowed into the country.

The customs area boss warned that the command will continue to frown at acts of infractions and will not hesitate to make arrests and seizures whenever the need arises.

He urged importers and agents to take advantage of the one stop shop compliance and dispute resolution mechanism aimed at achieving trade facilitation without compromising national revenue and security.