Business Maritime

FG To Collect 1% FSF At Ports, Cancels 25% Penalty On Imported Vehicle

BY EGUONO ODJEGBA

Apparently trapped between difficult choices, the Federal Government weekend stepped down its demand for the collection of 25% penalty on imported vehicle duty redemption, even as it throttled down on the collection of 1% Freight Stabilization Fee (FSF) at the ports.

While the FG notes that the planned collection of the 1% FSF by the Nigerian Shippers’ Council coming on the heels of the Steve Oransanya Report would begin in May 2024, it argues that the payment would not really add to the cost of doing business at the nation’s ports; all variables considered.

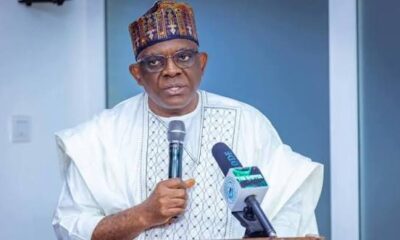

Coordinating Minister, Wale Edun and CGC B. A Adeniyi

The development coincides with the cancellation of 25% penalty recently imposed on improperly imported vehicles, who were given a grace period of 90 days to properly document and redeem their duty obligation by the federal ministry of finance.

The grace period effective 4th March 2024 to 5th July 2024 for the regularisation of import duties on specific categories of vehicles was earlier criticized as high handed and unnecessary. According to a statement by the NCS weekend, the Honourable Minister and Coordinating Minister of the Economy, Mr. Wale Edun was said to have approved the suspension of the 25% penalty “to ease economic hardship and encourage compliance.”

The statement with the theme ‘CANCELLATION OF 25% PENALTY ON IMPROPERLY IMPORTED VEHICLES’ signed by the Public Relations Officer of the Nigerian Customs Service, CSC Abdullahi Maiwada reads:

“The Nigeria Customs Service (NCS), under the directives of the Honourable Minister of Finance and Coordinating Minister of the Economy, has initiated a 90-day window, effective from 4th March 2024 to 5th July 2024, for the regularisation of import duties on specific categories of vehicles.

“To ease economic hardship and encourage compliance, the Honourable Minister and Coordinating Minister of the Economy have approved the suspension of the 25% penalty previously imposed in addition to import duty on improperly imported vehicles.

“Stakeholders, including vehicle owners, importers, and agents, are encouraged to seize this opportunity to regularise import duty payments within the designated 90-day timeframe.”

On the planned collection of the 1% freight stabilisation fee announced by the Nigerian Shippers Council purportedly in line with the recommendation of the Steve Oronsaye Panel Report on Restructuring and Rationalisation of Federal Agencies, Parastatals and Commissions which was recently sanctioned for implementation by President Bola Tinubu, the agency says the collection which is already scheduled to begin in May this year, will end the dependence of the council’s funding from external sources.

The Council Executive Secretary/CEO, Barr Pius Ukeyima Akutah who stated this on Thursday at the opening ceremony of the Council’s 2024 Strategic Management Retreat held in Abeokuta, Ogun State explains that the new development is line with the Council’s Act.

According to him, the Oronsaye report has directed the Nigerian Shippers Council to be self funding and not be given any subvention. While explaining further that the Shippers Council is currently running on handout of 2% from the 7% port development levy, lamented that the fund is grossly inadequate to carry out its mandate and assured that the 1% freight stabilisation fee would not add to the cost of doing business at the ports.

“The Oronsaye Panel Report is very clear on what Shippers Council should do, as much as other agencies have been merged together, some were completely disbanded, but the Nigerian Shippers Council under that report is suppose to generate its own revenue and be self funding.

“It is now, more than ever before that the Council needs to raise its revenue profile. The 1% freight stabilisation fee is a statutory funding for the agency, it is in our Act, but over time, the agency have not been able to implement that fee, now is the best time for us to go ahead and implement that.

“The 2% of 7% Port Development Levy which we have been using as source of funding for the Council, we can then leave that, because according to Oronsaye Panel, we are not supposed to be given any subvention. Once we achieve our 1% freight stabilisation fee which is statutory, we are not going to be asking for the 2% port development levy anymore, then we can start looking also for other sources of funding which we have responsibilities to fund the national budget and contribute to the national GDP.

“What the Shippers Council would be doing, going forward is to ensure we raise our revenue. Our regulations would be very friendly, they would be economic driven to ensure that we take up the role of a revenue generating agency and ensure that people profit from their investments.”

Akutah further explained that the development has the backing of the relevant authorities, noting that the NSC is too critical to the development of the port industry to lack the financial power and institutional wherewithal to fulfill its statutory duty.

“The Honourable Minister had given us a time frame of two weeks which has expired and we are working hard on it, we are developing a cost benefit analysis so that we can be able to manage our case very well. When we talk about this fund, people might think that it would add to the cost of doing business, but actually, if you look at the cost benefit analysis, you would know that it doesn’t add up to the cost of doing business.

“If we can achieve our 1% freight stabilisation fee and we begin to have the collection on a daily basis, we would not be waiting for someone at the end of the month to give us a handout to run the Council”, he declared.